how much is inheritance tax in nc

The tax rate on cumulative lifetime gifts in excess of the. Is there a federal inheritance tax 2020.

401 K Inheritance Tax Rules Estate Planning Smartasset

The estate tax is paid based on the.

. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10. For 2022 the annual exclusion is 16000. What is the federal inheritance tax rate for 2021.

North Carolina does not collect an inheritance tax or an estate tax. As previously mentioned the amount you owe depends on your relationship to the deceased. The estate tax is a tax on a persons assets after death.

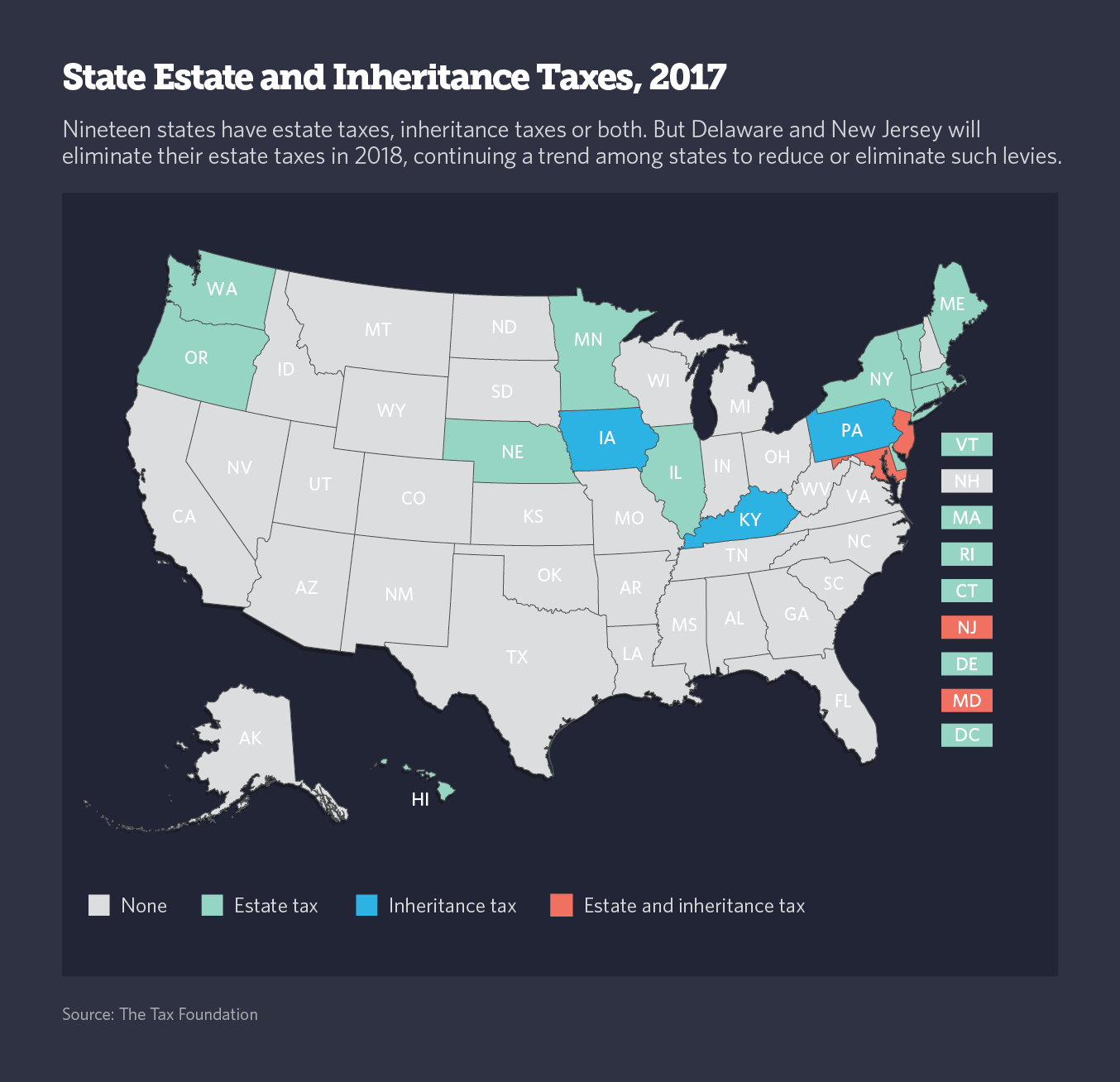

How Much Is the Inheritance Tax. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the. How much money can you inherit without paying inheritance tax.

In 2021 federal estate tax generally applies to assets over 117. Do you pay taxes on inheritance in north carolina Saturday June 11 2022 Edit. An inheritance tax is usually paid by a person inheriting an estate.

There is no federal inheritance tax but there is a federal estate tax. A few states have disclosed exemption limits for. Lets look at how estate and inheritance tax in NC works.

North Carolina Department of Revenue. The major difference between estate tax and inheritance tax is who pays the tax. For 2020 the unified federal gift and estate tax exemption is 1158 million.

Annual Gift Tax Exclusion. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. However state residents should remember to take into account the federal estate tax if their estate or the.

For Tax Year 2019 For Tax. If you are planning your estate you can also. Home File Pay.

Skip to main content Menu. No Inheritance Tax in NC. For a home valued at 500000 a 25-cent increase would add 1042 per month in local taxes.

There is no inheritance. The estate tax is a tax on a persons assets after death. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

You may pay taxes if you give a significant monetary gift to an heir while still living. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. Inheritance tax rates vary widely.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. In 2021 federal estate tax generally applies to assets over 117. What is the federal inheritance tax rate for 2021.

Gifts of less than 16000 per year per individual are not taxed.

State Estate And Inheritance Taxes Itep

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Death And Taxes Inheritance And Estate Tax In The Carolinas King Law

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

The Basics Of Nc Inheritance Laws Laskody Law Office Pc

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Inheritance Tax Archives Nc Policy Watch

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Children Taxation Mitigation Nc Planning

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State Estate And Inheritance Taxes

Inheritance Tax In Italy How Does It Work N26

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

How To Avoid Estate Inheritance Taxes In Nc Vail Gardner Law

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Understanding North Carolina Inheritance Law Probate Advance